Eureka! Cash for Gold in Stratford, CT

Buying and selling gold products, platinum, silver, and other precious metals can frequently lead to several questions, and those questions possibly lead to more—no need to fret, though. You are at the right place to get all of those questions answered!

To understand how to sell/buy/trade gold and precious metals, we need to look into the metal’s history of its value and origin.

The history of gold: Why is it so expensive, and where was it first discovered?

It’s challenging to determine precisely when humans first discovered gold and the use of gold products, but in around 560-700 B.C., the first gold coins appeared in circulation. Lydian merchants used stamped lumps of a silver and gold mixture called ‘electrum.’ Before then, the gold product wasn’t used for money as often as it was used to display wealth. Homer, the Greek author of the ‘Iliad and The Odyssey,” makes mention of gold as the sign of wealth beyond ordinary humans.

The silver/gold value ratio

We can find evidence of a silver/gold value ratio in the founder of the first Egyptian dynasty-‘the Code of Menes’, which states the first value-relationship between gold and silver: “One part of gold is equal to two and one-half parts of silver in value.”

Did you know that when Jason and the Argonauts searched for the ever-elusive and mystical ‘Golden Fleece,’ it referred to a primitive hydraulic mining method? Early miners would use the natural power of water and sheep fleece to trap the heavy but tiny flakes of gold, and once the fleece hit its holding capacity, it was hung up, dried, and gently beaten to disperse the gold so it was able to be recovered and used.

The first metal known to humans.

Dubbed as the ‘Tears of the Sun’ by the Incas, gold was the first widely known metal to early hominids. It is easily malleable; you can manipulate pure gold with your hands, and being highly malleable, gold was undoubtedly used ornamentally during its first discovery. Gold’s inability to rust or corrode linked it to the supernatural and early-time deities.

A newfound commodity

How did gold come to be a commodity? Well, as gold and its value became accepted throughout the world, early time manufacturers would melt the gold down into stamped coins and bullions that eventually became money altogether, completely dissolving the barter system due to gold’s much easier ability to be managed as well its permeance.

A concept born; How the Roman Empire paved the way for modern mining techniques and the birth of money.

While some of the greatest and earliest strides in mining development are due to the Greeks, in 323 B.C., having already mined from the Pillars of Hercules(Gibraltar) to Egypt. The Romans were by far the most extensive and advanced in the science of gold mining and their measurement of its monetary value.

Early hydraulic mining

The Romans used primitive forms of hydraulic mining. Diverting streams of water to carry the gold and wash away excessive sediment, building sluices to maintain water flow and power, and building the first ‘long toms’, an expanded rocker that featured a 10-to-20-foot trough. Introducing water-wheels, underground mining, and pioneering gold ore roasting to separate the precious metal from the outside rock made extraction more effective. Using this combination of their newly developed technologies, the Romans were victorious in mining even further in already abandoned mines, producing nearly six years of their military’s budget in silver and gold throughout their time.

Troy weight systems and Roman’s influence during the 15th century

The system of a unit of mass primarily used to value and weigh precious metals originated in England during the 15th century using the weight units grain, pennyweight, troy ounces, and the troy pound.

The Romans indirectly influenced this system with a similar system, their own Roman Monetary System. Bronze bars of various weights were used to value currency; an aes grave known as “heavy bronze” weighed one pound.

Troy weight was made official for silver and gold in 1527. However, in 1824, the British Imperial systems of weights and measures were established and adopted into the United States as the official weight standard for U.S. coinage by the Act of Congress in May 1828.

Troy ounces

The only modern and widespread use of the troy ounce is the British Imperial troy ounces and its American counterpart. The British Empire abolished the 12-ounce troy pound in the 19th century. In other countries where the International System of Units is mainly used, troy ounces are still used in precious metal markets. A troy ounce is mostly how gold is measured today.

Modern-day valuations and the current value of gold in the United States

As of 2022, 24k gold per ounce is approximately USD 1,937, with the price per gram at around USD 62. Something to consider when buying or selling your gold product or bullion/coins is that since gold is still the highest desired asset and commodity worldwide, its value changes depending on supply, demand, and market sentiment.

The value of the USD is not linked to the value of gold, but the value of gold is related to the U.S. dollar. This is important to note due to the relationship between the trade-weighted dollar index, also known as the broad index; used to measure the value of the US dollar relative to other world currencies, and gold can be a very complex relationship, so a general rule of thumb is that when the value of the USD increases relative to other currencies worldwide, the price of gold tends to fall in terms of the U.S. dollar.

Price per year and inflation

Throughout history, the prices of gold, silver, platinum are constantly in flux depending solely on what is in the current market. Over the last 20 years alone, the price of gold bars, gold bullions, or investment coins such as the Napoleon has climbed to a 400% increase in its euro worth.

The constantly changing price of gold per ounce

When someone refers to the current gold price per ounce, they typically refer to the ‘spot price’ of gold. Today’s gold spot price, like all days, is constantly changing. You can follow and be updated on the spot price of gold or the current market price by using MONEX Live Gold Spot Price Chart.

The highest price of gold in the US

According to a price chart displayed in August of 2020, gold prices hit a historic high of USD 2,074.88.

Buying and selling gold: What to research and expect

Depending on where you are and who you buy from, you’ll experience an array of prices and deals. You are in Stratford, CT, and are looking to sell your gold jewelry at a pawn shop for the most percentage of the spot price; the team of experts at Pawn King can help answer all of your questions offer you the best possible prices.

Physical gold, silver and gold bullion, coins, jewelry, you can expect their results to be precise and accurate with their state-of-the-art technology and experience. Using their Sigma Pro spectrophotometer to test billions and precious metals, they ensure nothing but accuracy.

You can also sell your gold scrap at their location at 70%-80% value. Pawn King is a safe haven for gold dealers, silver and diamond enthusiasts the like, offering real-time prices and trade.

Hard assets

Gold as an asset is also widely considered a safe haven in terms of protection against economic collapse, often saving investors from economic uncertainty. During times of said uncertainty in the past, investors were more than likely to buy gold to preserve their wealth or use the commodity as a safety net.

Gold as a hedge against the U.S. Dollar. What is a hedge concerning the stock market?

Due to the decline of the USD and inflation, gold has been used historically as a hedge against both. A hedge in terms of investment strategies means an investment made to reduce the risk of adverse price movements in an asset.

Using gold to preserve that wealth is extremely important for investors in the U.S., buying into the hard asset upon realization of any extra declination, knowing it will hold its value.

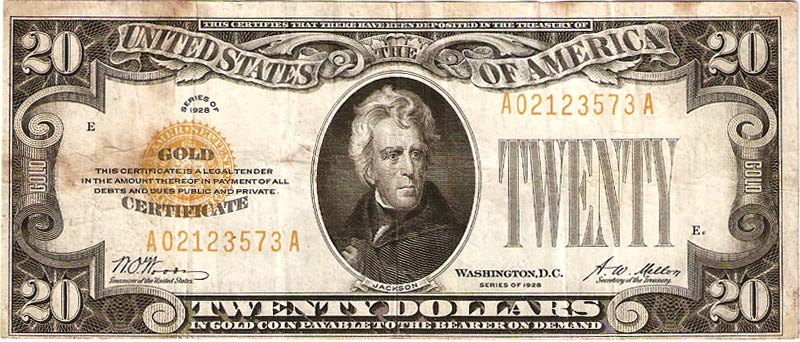

Investing; What are gold certificates?

Looking to start investing? Keeping an eye on the stock market is a great start, giving you great insight and a firm idea of current prices and deals around the world. If you are looking to start investing in gold, you first need to know how you can own and purchase gold and gold stock.

Gold Futures

Gold Futures is a CME Group specializing in providing global price discovery and opportunities for diversifying your portfolio beyond traditional gold product and mining stock investments. Future’s contract for gold trades nearly 27 million ounces daily, ensuring leading liquidity and mitigating 3rd-party risks.

Gold futures are standardized, exchange-traded contracts in which the contract buyer agrees to take delivery and a specific quantity of gold at a predetermined price and delivery date.

Gold Coins

Gold coins fall into four categories: Bullion, proof, numismatic, semi-numismatic. Gold bullion has recognized weight, can be in the form of coin or brick, and is stamped accordingly. Proofs are made in higher quality and fewer quantities, often featuring a more reflective or cameo appearance. Numismatic coins are older coins that have gained value among their collectors. Semi-numismatic have traits of both numismatic and billions.

Gold Companies

Investing in a gold company may look something like; investing in physical gold/asset, investing into EFTs and mutual funds, or trading futures and options in the commodities market.

Gold EFTs

Gold EFTs or gold exchange-traded funds allow an investor to purchase a commodity that consists solely of gold assets. Gold EFTs act as individual stocks and can be traded with contracts that are strictly derived and backed by gold and gold products.

Gold Mutual Funds

A gold mutual fund is a type of investment fund that holds assets related to gold. This could be bullion, gold futures contracts, and gold mining companies. This is a popular method that investors use as a hedge against inflation risks. The difference between ETFs and mutual funds is that EFTs can be traded during one day like stocks, while mutual funds only can be purchased at the end of each trading day based on a calculated price known as the net asset value.

Gold Jewelry

Investing in gold jewelry is a great way to reduce the risk of market volatility by acting as a hedge. Being untraceable, you can even use gold as a means of payment when not able to spend paper cash. There is a global market and high demand for gold jewelry, so many invest in gold products for that reason alone.

What are the four types of trade?

Day trading

Day trading is the act of buying and selling a financial instrument within the same day or sometimes multiple times a day; it can be high risk but very lucrative if successful.

Position trading

Position trading is almost like trend following; an investor will identify a trend, buy and hold it until the trend is at its’ peak.

Swing trading

Swing trading usually takes trades that last over a few days or months to anticipate profitable price moves.

Scalping

The role of a scalper stock trader is the role of market makers or specialists who maintain the liquidity and order flow of a product of a market.

Buying and selling gold can become a complex and often a high-risk/high reward process. Luckily it’s also a very informative, and relatively profitable product. So whether you buy the yellow-precious metal purely for aesthetic purposes or to hold it as an investment, you know you are getting your money’s worth!

Pawn King

Pawn King, located in Stratford, CT is here for you. As a reputable, honest, and family-owned business, the experts in the pawnshop are able to answer questions about gold, spot prices, day trading, precious metal investorments, and how to sell gold for the most money while considering all the factors along the way.

Gold investors are always welcome to visit the pawnshop and see if any of the bullion coins, gold and silver jewelry, or other gold products will be something to invest in.

Pawn King has a wide array of other valuable products like musical instruments, electronics, gold and silver jewelry, name-brand power tools, and collectibles. As a full-service pawn shop offering buying, selling, and pawn service, Pawn King, is here to help.